A $30 vape just gave the gadget world a hearty chuckle.

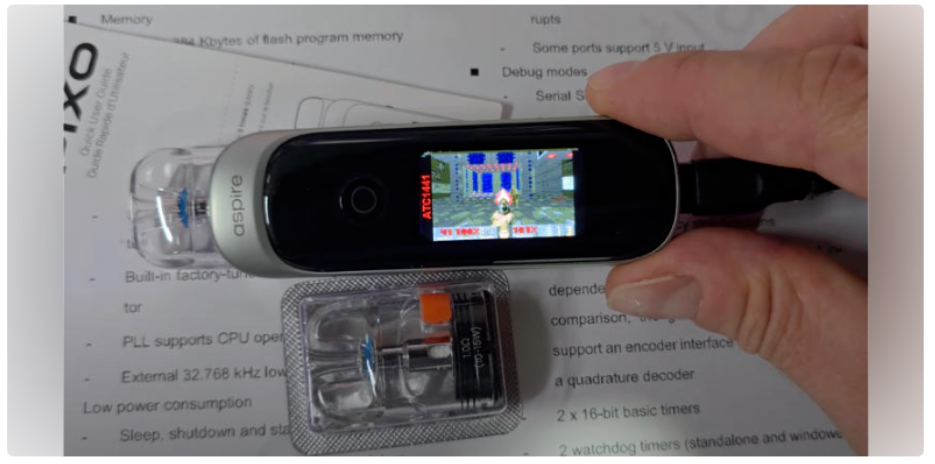

Hardware hacker Aaron Christophel managed to get the classic 1993 shooter DOOM to play on an Aspire Pixo Kit e-cigarette.

Okay, fine—the game isn’t natively running on the vape’s chipset. He streamed the video feed through USB to the kit’s tiny 1.5-inch color screen. But still, watching a vape pen blast demons is peak geek.

Not Just a Gimmick

Beneath the meme-worthy stunt lies a serious hint about where vaping hardware is headed.

Specs that tell the story

- 32-bit Arm chip (PY32F403XC)

- 1.5-inch color touchscreen

- Flashable firmware

Translation: this “nicotine stick” is basically a wearable smart device already—display, processor, connectivity and all.

Vapes as Pocket Gadgets

If an e-cig can run DOOM, what’s stopping it from doing… well, anything?

- Personal dashboards: track your puff count, nicotine intake, and even sync with your smartwatch.

- Gamified habits: mini games, achievement badges, or virtual pets to help you quit (or at least track).

- Social sharing: cloud data that lets friends compare progress or flavor experiments.

- Third-party plug-ins: like an app store for your vape.

Today it’s DOOM. Tomorrow it could be dynamic skins, AI assistants, or a vape-sized Tamagotchi.

Cultural Curveball

This hack also moves e-cigs into geek-culture territory.

Gen Z might see a “vape that runs DOOM” less as a tobacco product and more as a cool digital toy.

For an industry under heavy regulation, that kind of techy branding could be a golden rebrand—if done carefully.

The Regulatory Reality Check

Fun as it sounds, regulators are not known for their sense of humor.

- Anything that looks like it’s enticing minors is a red flag.

- Too much “toy” or “game” energy risks getting classified as beyond the “intended tobacco function.”

- Extra entertainment features could trigger new compliance hurdles.

Possible safe path: “health gamification”—using the screen for quit-smoking challenges, environmental sensors, or wellness stats rather than pure fun.

The Bottom Line

The Aspire Pixo experiment isn’t just a hacker flex. It’s a neon sign pointing to the next five years:

vapes morphing from plain nicotine dispensers into pocket smart devices.

Whether that future sticks will depend less on engineering and more on how far regulators let the fun go.